Seller 1099 Form

For example if someone buys an investment property for 100000 and sells it for 150000 giving them 50000 of capital gains income theyre supposed to report this as taxable income at. Additionally this document can also be used to.

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

1099-S Reporting Form The filing fee per reporting form is 1000 If you enter online the fee is 700.

Seller 1099 form. What is a 1099-K form. If youre an individual online seller dont worry. IRS Form 1099-K was introduced in 2008 by the Housing Assistance Tax Act.

A 1099-K form is a sales reporting form issued by Amazon and similar businesses. Beginning in January 2022 anyone who sells more than 600 worth of goods through on the online auction site or rivals like Etsy or Facebook Marketplace will receive a 1099-K form detailing the transactions for the IRS. You can also retrieve the form from your seller account.

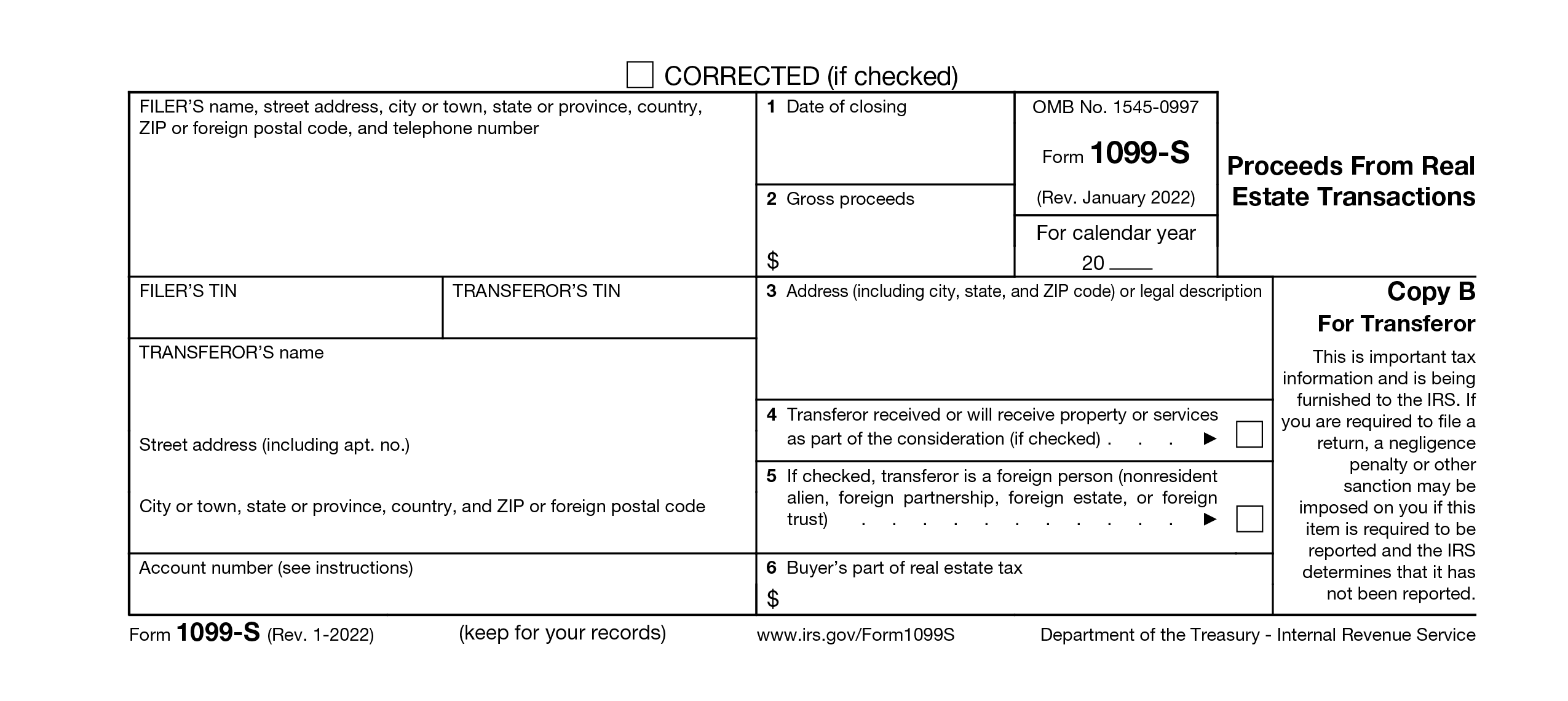

It is because the real estate sellers are usually objected to capital gains tax when the property is sold. Enter the amount of each split into the Sellers Gross Allocation field. See more on 1099-S substitute and exemption forms.

File this form to report the sale or exchange of real estate. Information to assist Sellers in the completion of the 1099-S Certification and 1099-S Input Form. Next year this is all going to change.

If you sell 20000 and have 200 or more transactions then you will file a form 1099-K. 1099 Form 2021 1099 S 2021 The 1099 S Form is really a tax document issued by the IRS that is used to make sure that the received amount of funds over real estate transactions is reported correctly. For sellers receiving 0 of the gross proceeds a 1099-S form is not required.

New level on sending out 1099 from eBay for 2022 60000 03-12-2021 0811 AM. If an eBay retailer who meets the thresholds doesnt report their eBay income on their tax return the IRS would know automatically because they would have already. You will file a 1099-NEC if you sold more than 600 in goods as discussed.

All information required by IRS CJ Account Number Name Telephone Number. 1099-S Provided - Indicates that the form has been provided to the customer. The will calculate automatically based on the amounts entered.

Other states are considering or implementing lower thresholds too. The form can show either spouse as the seller and the sale proceeds do not need to be allocated between them. Each Seller must complete a 1099-S Certification form Husband and Wife must each complete a separate form.

All information required by IRS 1099-S Reporting Form Section 6045e of the Internal Revenue Code as amended by the Tax Reform Act of 1986 requires that information regarding certain real estate transactions be CJ Account Number. Are the reported amounts on my Form 1099-K in USD or local currency. The Form 1099-K was mailed to the address you provided in the tax interview.

Seller Please indicate if Power of Attorney or Attorney in Fact CLOSING AGENT OR ATTORNEY INFORMATION. A freelancer typically reports non-employee compensation on a 1099-NEC but since you are using an online platform you have a different form. Yes No Buyers Portion of Real Estate Tax ie tax credits received by seller.

It provides the IRS with annual and monthly gross sales information and includes sales tax and shipping fees. Property Services Received - Indicates that this order is a 1031 Exchange. 1099-S CERTIFICATION EXEMPTION FORM.

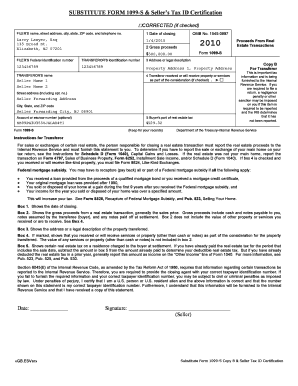

Seller Please indicate if Power of Attorney or Attorney in Fact CLOSING AGENT OR ATTORNEY INFORMATION. This form may be completed by the seller of a principal residence. You are not required to indicate on Form 1099-S that the transferors sellers financing was federally subsidized.

The most common IRS tax form youll need to deal with as an eBay 1099 business is the 1099-K. The 1099-NEC form is replacing the 1099-MISC form from last year for classified non-employee work as of tax year 2020. Information about Form 1099-S Proceeds from Real Estate Transactions Info Copy Only including recent updates related forms and instructions on how to file.

So this seems to be going around now that the new stimulus bill was signed. They even send it to both you and the. However if the seller answers NO to any of the questions on the form a 1099-S must be filed.

Instead an exemption form can be used. The due date for IRS paper filing March 15th 2021. For now only sellers who move 20000 worth of goods and complete at least 200 transactions have their activity automatically.

Click the Download PDF link. For 2020 taxes this would be February 1st 2021. And the due date for E-filing is March 31st 2021 for the 2020 tax year.

Foreign Person - Indicates if the seller is a foreign entity. SELLERS OR EXCHANGERS CERTIFICATION FOR NO INFORMATION REPORTING TO INTERNAL REVENUE SERVICE ON THE SALE OR EXCHANGE OF A PRINCIPAL RESIDENCE. 0 gross proceeds allocation.

If the sellers were married at the time of the sale they are treated as a single seller for the purposes of issuing a Form 1099-S. On it ot states if you make 60000 you will now get a 1099 not the 20k 200 trans. The purpose of IRS Form 1099-S is to ensure that sellers are reporting their full amount of capital gains on each years tax return and thus paying the appropriate amount of taxes to the IRS.

Prior to this transaction was the subject property the sellers principal residence. You should receive your 1099-K from eBay after January 31. Also you are not required to enter the following.

You dont have to fill out this document. _____ I _____ do swear and depose that the above information is correct and understand that it will appear on a Form 1099 that will be sent to me and to the IRS. After January 10th add 500 per reporting form for previous tax year.

This is a tax form that has been designed to ensure that online retailers such as eBay sellers are reporting taxable income. To comply with IRS regulations requiring reporting of the sale or exchange of Real Property follow the instructions below. Tax Forms Youll Receive As An 1099 eBay Seller.

In those cases when the seller is a partnership only one Form 1099-S needs to be issued to the partnership. In the past the IRS has only required online sellers to submit a 1099-K tax form if they partake in at least 200 transactions worth in total at least 20K. From the Reports section select Tax Document Library then the appropriate year and then Form 1099-K.

Amazon does it for you. 1099-S CERTIFICATION EXEMPTION FORM. Both total gross proceeds and the allocated gross proceeds for a multiple transferor transaction enter either one or.

Seller Proceeds and 1099-S screen can be found under the EscrowClosing screens 1099 Checkbox definitions. Each seller who has switched over to MP could get 1099s from both processors or just one or neither depending on what was processed by each company. The due date for form 1099-S to be sent to the recipient seller or sellers is February 1st.

And also depending on their states threshold. On the sale of a primary residence the IRS requires the person who closed the transaction to obtain a completed 1099-S Certification Form from the seller and retain the signed form in the file for four years. This information is necessary to determine.

What Is Form 1099 S 1099 S Filing Reporting

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Requirements Deadlines And Penalties Efile360

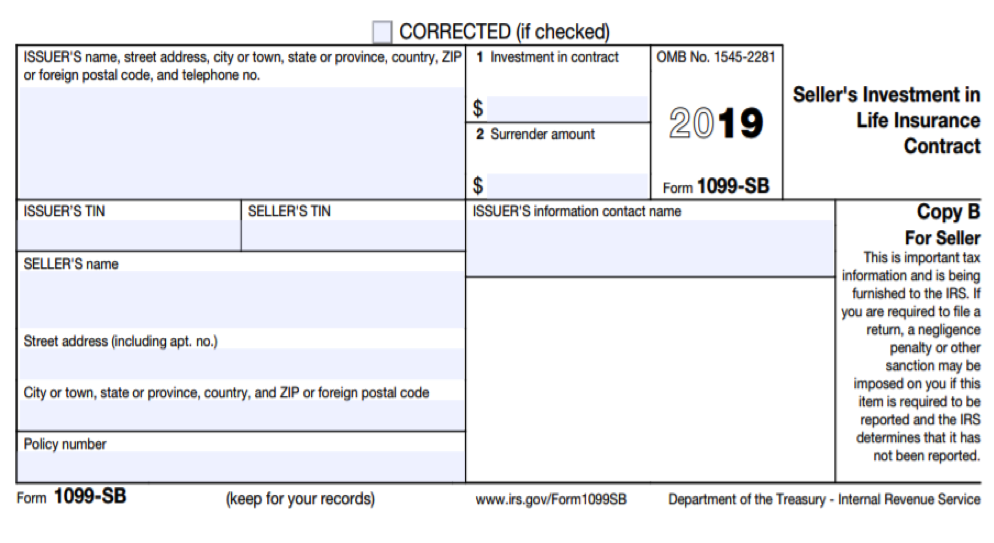

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Substitute Form 1099 S Pdf Fill Online Printable Fillable Blank Pdffiller

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Irs 1099 S Substitute Form Fill And Sign Printable Template Online Us Legal Forms

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

This blog information is very useful to everyone. Thanks for sharing. Get services of form 1099 online

BalasHapus