6 Seller Concession

6 seller concessions for loans with LTVs between 75 and 90. 6 seems like an awful lot of money.

What Are Closing Costs Sellers Concession How Much They Are Closing Costs Seller Appraisal

6 maximum if the buyer puts down 10 to 25 on a primary or secondary home.

6 seller concession. What is the maximum seller concession on a conventional loan. Seller concessions are when a VA home buyer asks the home seller to pay costs associated with the VA Loan on the home buyers behalf. 3 maximum if the buyer puts down less than 10 on a primary or secondary home.

FHA and USDA loans allow up to 6 percent in seller concessions. Should your concessions exceed 6 it will result in a dollar-for-dollar reduction to your home loan purchase price. Youre able to use 21000 in seller concessions if the seller agrees to assist you.

The FHA limits seller concessions to 6 of the loan amount. Based on a national median home value of 226300 the typical borrower pays 4526 to 11315 in closing costs. A seller concession is where the seller can choose to cover some of the closing costs to cut down your out-of-pocket expenses.

Its important to note that the seller paid closing costs for USDA loans cannot be any price you chooseUSDA seller concession limits are limited to 6 of the loan amount. 295k asking 299k no money down 100 financing and the potential buyers want me to pay 6 towards their closing costs 6 in seller concessions. USDA Up to 6 Conforming Up to 9 depending on the down payment.

Thats nothing to sneeze at though. So if youre buying a primary residence for 310000 with a conventional loan and youre putting down 12 percent or. Im trying to sell my home received the following offer.

Seller concessions can cut these costs significantly so you dont have to completely empty your savings to buy a home. There are definite limits to how much the seller can offer in concessions if the mortgage is financed typically such as with a Hud Loan. One difference between FHA and USDA loans and the amount of seller concessions that are allowed is that if a bank appraiser can determine concessions over 6 does not negatively impact value there are cases a buyer is able to receive more than 6 in seller concessions.

6 percent however should be more than adequate for a sellers concession. Seller concessions can help you save if they reduce the amount you have to pay at the closing table. A VA mortgage permits up to 4.

Thats nothing to sneeze at though. I dont think theyre putting any type of good faith deposit down either. Sellers could also agree to a seller concession of repair costs for damages that were discovered.

A seller is able to contribute up to 6 in seller concessions just like FHA loans. Note that if the home appraises for less than the sale price of the home the seller concessions limits will be capped based on the appraised value rather than the homes purchase price. As of February 2020 Fannie Mae guidelines set caps on seller concessions also called interested party contributions IPCs for conventional loans as follows.

For USDA loans the 6 seller concession limit is calculated using the buyers loan amount rather than the sale price or appraised value. A seller concession is when a buyer asks the seller for a monetary contribution towards their closing costs escrows andor pre-paids. This amount of money will be deducted from the sellers proceeds.

If the appraised home value is less than the purchase price the seller may still contribute 6 of the value. Seller concessions allow you to pay less at closing to make buying a home more affordable. As a buyer youll usually have to bring at least a few thousand dollars to the table for closing costs and your down payment.

Why This Works. The USDA loan restrictions are a little different with a 6 limit on contributions but instead of using the sales price or the appraisers valuation the mortgage lender uses the loan amount. Seller concessions on all investment properties are capped at 2.

Benefits Of Seller Concessions. If you come into an offer with a 6 seller concession and another bid comes in for 3 most likely the seller is going to go with the 3 seller concession offer because he is going to save 3 by going with that deal instead of paying an entire 6 towards your closing costs. And 3 seller concessions for loans with an LTV over 90.

A sellers concession works because you voluntarily raise the sales price of your future home to cover whatever amount youve asked the seller to pay. Asking a seller for concessions can mean less cash out of pocket to finalize the. Put simply a seller concession - sometimes also referred to as a seller assist - is a gift that the sellers give buyers in order to reduce the upfront cost of.

A conventional loan for example will allow up to 9 seller concessions for loans with a loan-to-value LTV of 75 or less. Types of seller concessions include. Im not in a hurry to sell.

A conventional mortgage allows from 2 to 9 in seller concessions. One reason a seller might agree to a seller concession is to make a hard-to-sell property more attractive to buyers. USDA Loans and Seller Concessions Contribution Limits.

For all FHA loans the seller and other interested parties can contribute up to 6 of the sales price or toward closing costs prepaid expenses discount points and other financing concessions. Say youre financing a 350000 home. Typically those concessions will be capped at around 4 to 6 percent of the loan.

Concessions can sweeten the deal but there are limits as to the number of perks allowed in relation to the type of mortgage the buyer is taking out. Prepaying taxes and insurance on the home. Closing costs generally run 2 to 5 percent of the homes purchase price.

So a 200000 house becomes a 212000 home on paper if you need six percent or just a 208000 house if you need four percent. Unless the seller owes more than their home is worth then theyd have to bring the funds to closing. The VA permits seller concessions but requires that seller concessions do not exceed 4 of the loan amount.

If youre using an FHA loan you should be aware that the Federal Housing Administration caps seller concessions at 6 of the sale price. Investment properties are capped to 2 of.

Request A Sellers Concession By The Seller To Offset Closing Costs Real Estate Trends Real Estate Home Selling Tips

Stay 6 Ft Apart Reminder Decal Choose Your Size Food Truck Concession Sticker Harboursigns Sticker Sign Dog Decals Reminder

2011 8 X 6 Columbia Dream Maker Concession Trailer Never Used Concession Trailer Concession Steam Recipes

Horse Trailer Mobile Bar Gin Fizz Coffee Bar Wedding Festival Hire Business Tiny House Bar Barginfizz Bus Mobile Bar Verkaufswagen Mobile Cocktailbar

Sample Printable Copy Of Projected Foreclosure To Reo Cost Analysis Form Business Letter Template Letter Templates Lettering

Afr Announces Homebuyer Program To Grant 2 Of Purchase Price 6 Of Closing Costs Closing Costs Mortgage Loans Loan

Outsanding Agents Outstanding Results Realtorsofinstagram Realestategoals Realestateprofessi Real Estate Buying Real Estate Sales Front House Landscaping

Are You Ready For Homeownership These Zero To Low Down Payment Loans Are Awaiting You Follow Nawlinsrealtor Pond Home Ownership The Borrowers Down Payment

Seller Contribution Cost Cheat Sheet 03 2017 Investing Cheat Sheets Cheating

Grub Tub On Display Yankees Menu Board Cheese Fries Hot Chicken Grubs

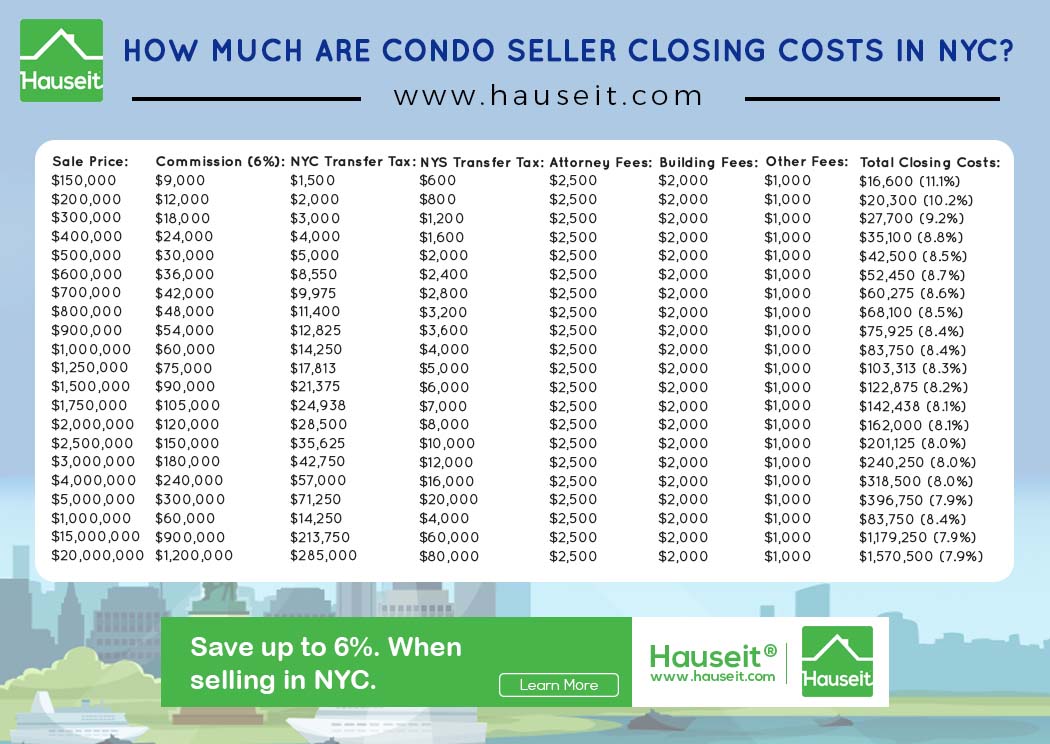

Seller Concession Towards Closing Costs Hauseit Closing Costs Concession Cost

What Not To Do As A Desperate Seller In Nyc Desperate Nyc Seller

Nys And Nyc Real Estate Transfer Tax Overview For Nyc Nyc Real Estate Real Estate Infographic Nyc Infographic

New 2021 6 X 14 Enclosed Concession Mobile Kitchen Food Truck Vending Trailer Ebay In 2021 Verde Island Cape Verde Islands Concession Trailer

Posting Komentar untuk "6 Seller Concession"