If Seller Receives Back The Goods Sold He Will Prepare

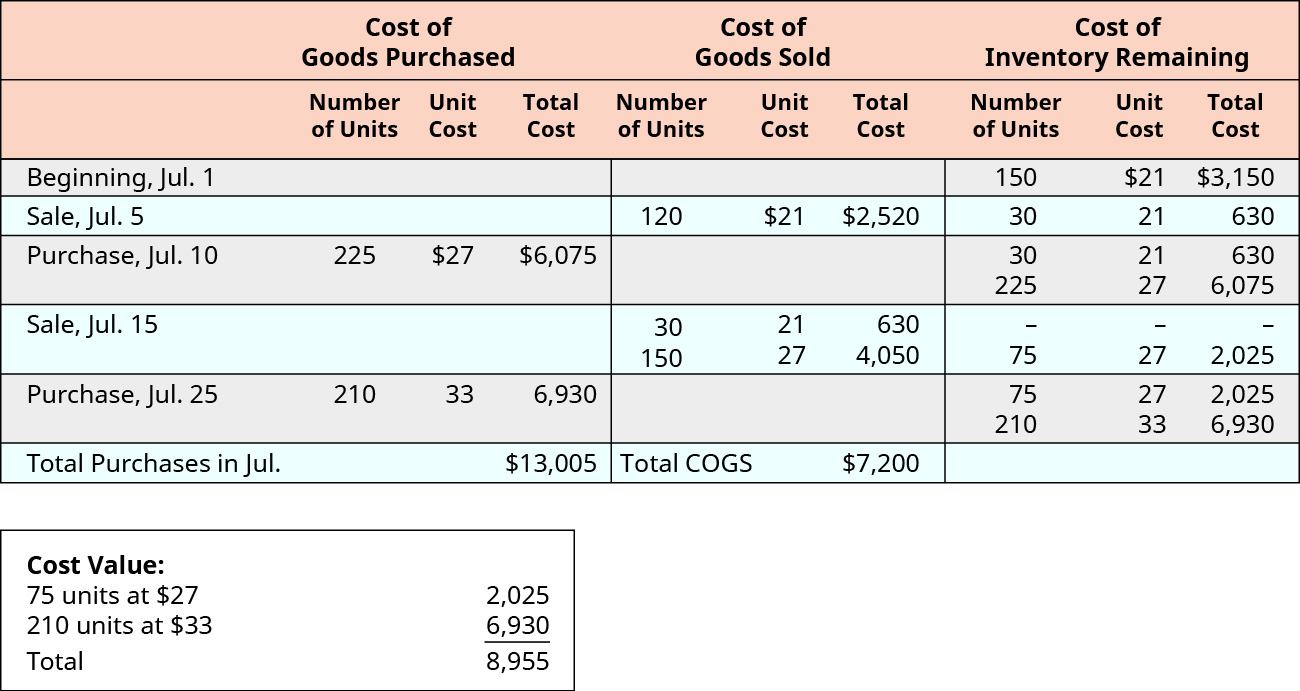

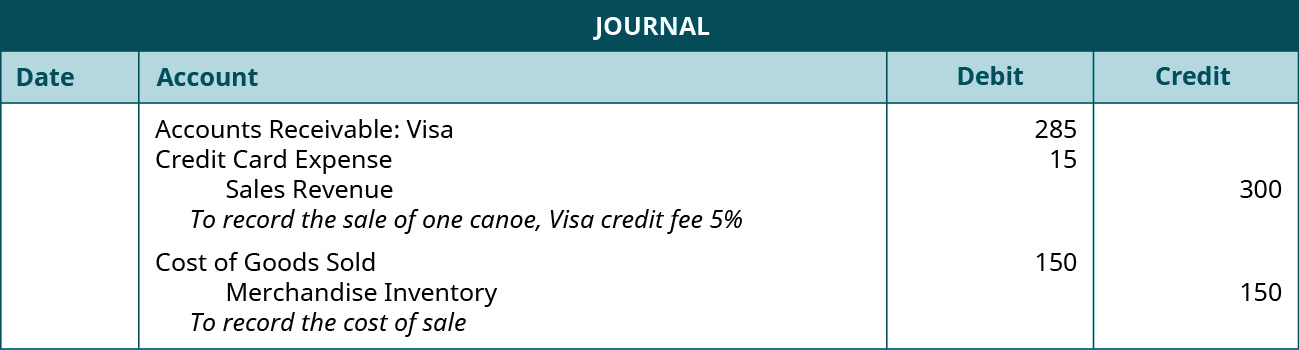

In this case we say there is a. Both Sydney and Troy use a perpetual inventory system and the gross method 1.

What Is A Letter Of Credit How It Works And Who Needs It

The seller is not obliged vis-à-vis the buyer to conclude an insurance contract.

If seller receives back the goods sold he will prepare. In particular suppose that a seller is trying to sell an item that he values at x and suppose that the maximum value held by a potential buyer of the item is some larger number y. 22 Of the merchandise sold on July 19 300 of it was returned. 64Paden Company purchased merchandise from Emmett Company with freight terms of FOB shipping point.

If a purchases account is being used add the balance in that account to the beginning inventory total and then subtract the costed ending inventory total to arrive at the cost of goods sold. Obtain manufacture prepare or select goods with which to fulfill his obligation under the contract. Costs transfer from the seller to the buyer when the goods are placed at the disposal of the buyer Risk is often managed through using a Marine insurance policy.

One day as i was ready a blog i saw a testifier made by someone in Australia called Jessica telling people about how this man call Dr Zuma helped her and the mans contact email was there and his mobile number then i contacted him for a help and really he brought back my husband now am so happy my brothers and sister if you are in such. In operating expenses for the seller. However he must provide the buyer at his own expense with the document enabling him to take delivery of the goods.

B Cash and Credit sales. The unpaid sellers right can be exercised by an agent of the seller to whom the bill of leading has been endorsed or a consignor or an agent who has himself paid or is directly responsible for the price. Rights of an unpaid seller.

If seller receives back the goods sold he will prepare. Determine the cost of goods sold. Question If seller receives back the goods sold he will prepare a Credit Note.

D None of these. The returned goods had cost Troy 804. If purchaser of goods returns them he will prepare a Credit Note.

A transfer of value takes place between a buyer and seller when the buyer receives goods in accordance to a sales order approved by the buyer and seller and the seller receives payment or a promise to pay from the buyer for the goods purchased. If the firm is instead using several inventory accounts instead of a purchases account then add them together and subtract the costed ending inventory total to arrive at the cost of goods sold. Once the goods have been identified relative to the contract Title to the goods may pass to the Buyer.

In any case a buyer may agree to extend the time for delivery of conforming goods. The sale of Goods Act has expressly given two kinds of right to an unpaid seller of goods. The consumer would not need to provide a reason for sending back any items.

A seller uses a perpetual inventory system and on April 4 it sells 5000 in merchandise its cost is 2400 to a customer on credit terms of 310 n30. 19 Sold merchandise on credit for 4400 terms 110 n30. 9 Paid freight charges of 90 on the items purchased July 6.

A Marine insurance policy usually includes a Warehouse to Warehouse clause. B Debit Note c Both a and b. C Both a and b.

The seller may have to repair or replace an item if. The merchandise had an inventory cost of 2700. At some stage in the process the seller will have identified the goods which he intends to ship or deliver or hold for the buyer.

A __ is an innocent third party who acquires the rights to goods that were sold by a defrauded seller. A credit note is prepared when goods are received back from a customer. Business Law - Lesson 161 Activity.

D None of these. Tally package is developed by. Start by considering the case in which the seller and buyers know each others values for an item and argue that an auction is unnecessary in this scenario.

When the buyer overcharges the sellers account he issues the credit note. A person who buys stolen goods from a thief receives possession but not ___ to the goods. To a contra-revenue account of the seller.

Once you receive the goods back you would need to refund the customer within fourteen 14 days. Related Questions on Tally. Voucher is prepared for a Cash and Credit purchases.

A seller has the right to cure nonconforming goods if he gives notice to the buyer and if conforming goods can be delivered before the last date for delivery under the sales contract. Mandatory Repairs and Replacements. D None of these.

Buyer and the seller. May 12 Sydney returns 1200 of the 33500 of goods to Troy who receives them the same day and restores them to its inventory. When the supplier gets back the goods sold by him to the buyer then also credit note is issued.

Revenue must be realizable. However he has no obligation to carry out customs clearance on import. The reasons for issuing a credit note is as under.

The note is prepared with red ink. To the cost of goods sold of the seller. May 20 Sydney pays Troy for the amount owed.

Troy receives the cash immediately. Solution By Examveda Team A debit note is sent to the seller when he is taken back the sold goods. When a seller receives goods returned by the buyer which were once sold on credit the seller also expects some form of confirmation from the buyer on paper related to the details of returned items.

__ goods exist physically even though they may not be fully assembled or deliverable. A debit note is a document sent by a buyer to the seller to confirm the details of goods returned return outwards and create an obligation for the seller to cancel the related dues. However a cash memo is prepared when trader sells the goods for cash.

The freight costs will be paid by the a. C Both a and b. When goods are purchased on credit the seller prepares a sale invoice called bill that contains the name of the party to whom the goods are sold as well as the rate quantity and total amount of the sale.

The Incoterm DPU obliges the seller to clear the goods for export. The plain meaning is insurance coverage on cargo continues in force during the ordinary and customary. Invoice cost of merchandise purchases-purchases discounts received-purchases returns and allowancescost of transportation_intotal cost of merchandise purchases.

Acceptance of the goods occurs if the buyer 1 expressly indicates acceptance 2 fails to notify the seller of rejection of the goods within the agreed-on trial period or if no time is agreed on a reasonable time or 3 uses the goods inconsistently with the purpose of the trial eg a customer resells a computer to another person. 8 Returned 100 of the items purchased on July 6. A buyer can also send credit note in case the seller undercharges him.

Difference Between Debit Note And Credit Note With Comparison Chart Key Differences

Latihan Soal Penilaian Akhir Semester 2019 Bahasa Inggris Kelas 12

Laurel Wreath Svg Round Circle Monogram Frame Leaves Leaf Etsy In 2021 Circle Monogram Monogram Frame Wreaths

If Seller Receives Back The Goods Sold He Will Prepare

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

Mcqs For Accountancy Chapter 3 Recording Of Transactions I

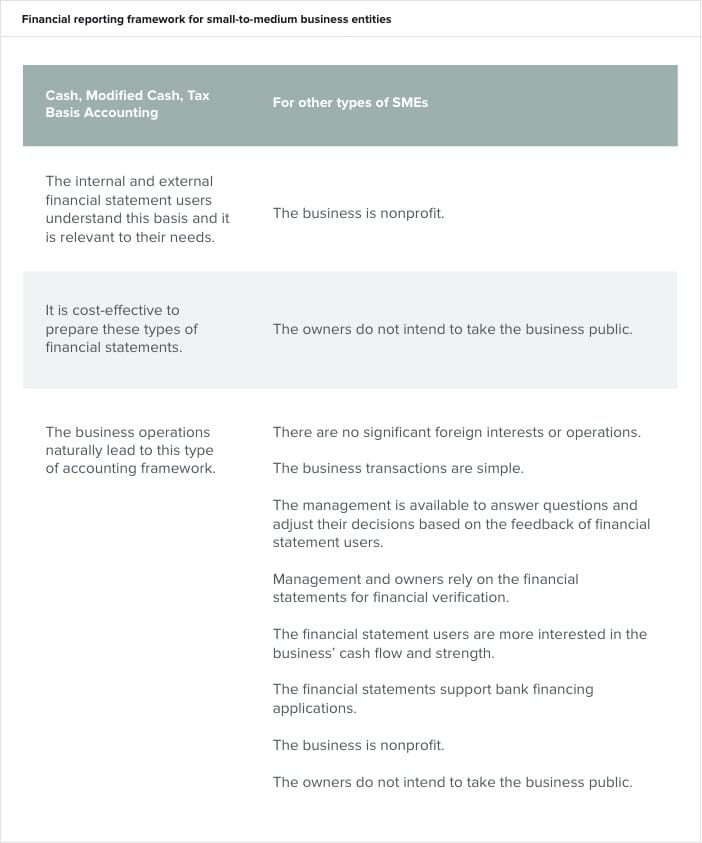

Accrual Accounting Concepts Examples For Business Netsuite

Difference Between Debit Note And Credit Note With Comparison Chart Key Differences

If Seller Receives Back The Goods Sold He Will Prepare

Explain The Revenue Recognition Principle And How It Relates To Current And Future Sales And Purchase Transactions Principles Of Accounting Volume 1 Financial Accounting

Posting Komentar untuk "If Seller Receives Back The Goods Sold He Will Prepare"