Seller Of The Call Or Put Options Have Only Two Alternatives

All options have the same expiration date and are on the same underlying asset. Call Option Exercise Price.

Put Options Explained What They Are How They Work Ally

As the standard deviation of the returns on a stock increase the value of a put option increases.

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

Seller of the call or put options have only two alternatives. Both options have the same maturity. As the option is a call option exercising the option means you will buy the shares at the exercise price of 25. Both a put option on 1250 with an exercise price of 1000 and a portfolio of options.

The put option seller known as the option writer does not need to hold an option until expiration and neither does the option buyer. Warrants cannot be traded after they have been purchased. These are the differences between call and put options.

The number of warrants is fixed whereas the number of exchange-traded options in existence depends on trading C. A put on 1250 with a strike price. A call option allows buying option whereas Put option allows selling option.

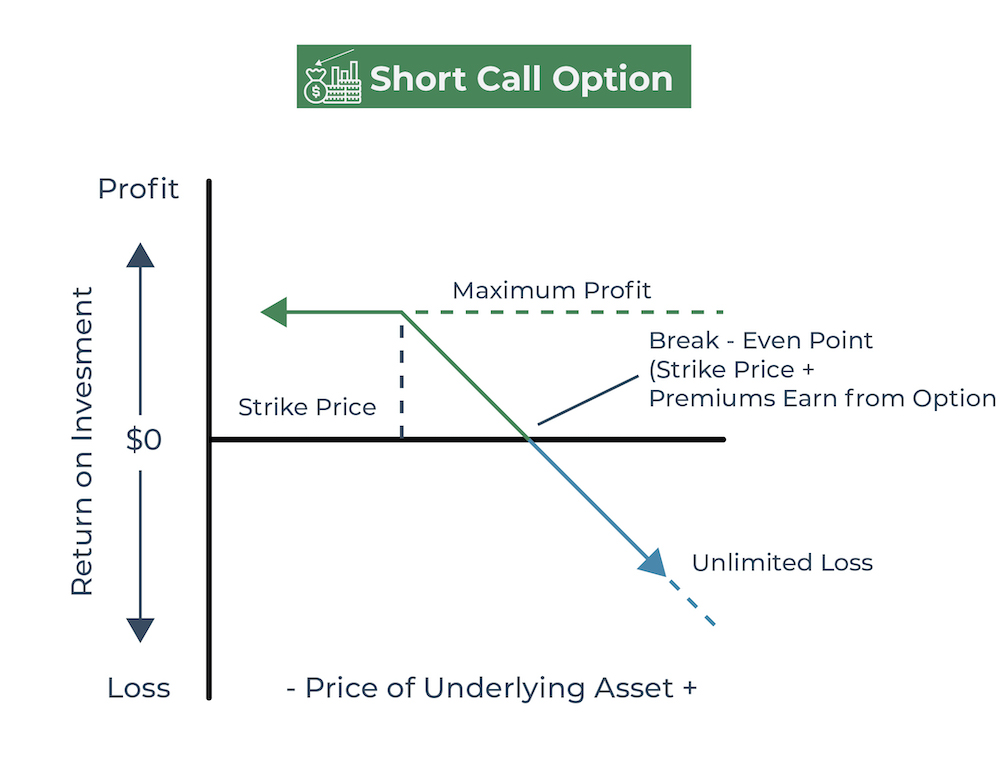

How Put Options Work. A call option would normally be exercised only when the strike price is below the market value of the underlying asset while a put option would normally be exercised only when. An investor would sell a put option if their outlook on the underlying was bullish and would sell a call option if their outlook on a specific asset was bearish.

Investors buy puts when they believe the price of the underlying asset will decrease and sell puts if they believe it will increase. Exchange-traded stock options have a strike price D. The value of a call option decreases as the time to expiration increases.

If you bought a call option and the price has gone up you can always just sell the call on the open market. Bull Call Spread A risk defined and reward defined alternative to buying call options. Simply put investors purchase a call option when they anticipate the rise of a stock and sell a put option when they expect the stock price.

When a trader buys a put option they are buying the right to. You would only exercise if it is profitable. A call option gives the investor the right to purchase a given number of shares of a specified stock at a set price.

Increasing the strike price increases the value of a put option. A call option on 1000 with a strike price of 1250 is equivalent to a put option on 1000 with an exercise price of 1250. The buyer of a call option pays the option premium in full at the time of entering the contract.

Buyers of European-style options may exercise the optionsell the underlyingonly on the expiration date. I and III only B. On the other hand selling a put gives an immediate profit inflow with potential for future loss with no cap on the risk.

At the same time they will also sell an at-the-money call and buy an out-of-the-money call. Put options offer an alternative route of taking a bearish position on a security or index. The writer seller of the put option is obligated to buy the asset if the put buyer exercises their option.

The call costs 3 and the put costs 4. A put option has risk since leverage is. A put option is an option contract that gives the buyer the right but not the obligation to sell the underlying security at a specified price also known as strike price before or at a predetermined expiration date.

Draw a diagram showing the variation of the traders profit with the asset price. Alternatives to Exercising a Put Option. Calls and Puts.

- Buying a call gives an immediate loss with a potential for future gain with risk being is limited to the options premium. That person that takes the opposite side of the call option buyer is the call option seller Sometimes it is referred to as the call option writer Just to be clear here there are really two types of call option selling. Put options are the opposite of call options.

A seller of the stock option is called an option writer where the seller is paid a premium from the contract purchased by the stock option buyer. A trader buys a call option with a strike price of 45 and a put option with a strike price of 40. An investor may enter into a long put a long call a short put or a short call.

A decrease in the risk-free rate increases the value of a put option. The seller may grant an option to a buyer as part of another transaction such as a share issue or as part of an employee incentive scheme otherwise a buyer would pay a premium to the seller for the option. II and IV only.

A put option gives the investor the right to sell a given number of shares of a stock at a set price. Buying the option means you pay this price to the seller. Figure S94 shows the variation of the traders position with the asset price.

In a warrant issue someone has guaranteed the performance of the option seller in the event that the option is exercised B. The call generates money when the value of the underlying asset goes up while Put makes money when the value of securities is falling. Thus if one holds a bullish view one must choose between buying a call and selling a put based on his risk bearing ability.

The call and put. For US-style options a put options contract gives the buyer the right to sell the underlying asset at a set price at any time up to the expiration date. It is one of the two main types of options the other type being a call option.

Bear Put Spread A cheaper alternative to buying put. It is one of the two main types of options the other type being a call option calls Call Option A call option commonly referred to as a call is a form of a derivatives contract that gives the call option buyer the right but not the obligation to buy a stock or other financial instrument at a specific price - the strike price of the option - within a specified time frame and the underlying. 25th May 30 days until expiration The market price of this call option 12.

Options Theta Explained Option Alpha

Summarizing Call Put Options Varsity By Zerodha

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

10 Options Strategies Every Investor Should Know

Understanding Put Call Parity The Options Futures Guide

Summarizing Call Put Options Varsity By Zerodha

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

Options Trading Strategies A Guide For Beginners

Put Options Explained What They Are How They Work Ally

Basic Options Strategies Explained The Options Bro Option Strategies Call Option Options Trading Strategies

Call Option Example Meaning Investinganswers

Bull Put Spread Explained Online Option Trading Guide

Summarizing Call Put Options Varsity By Zerodha

Put Options Explained What They Are How They Work Ally

/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Options Trading Strategies A Guide For Beginners

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Posting Komentar untuk "Seller Of The Call Or Put Options Have Only Two Alternatives"